Large organizations encounter a variety of difficulties in the fast-paced business environment today that may have an effect on their operations and bottom line. These companies’ risks are varied and complex from cyber threats to regulatory compliance issues.

That’s why conducting regular audits is crucial for any organization to stay ahead of the game and protect itself from pitfalls. In this blog post, we will explore some of the critical reasons every large organization should focus on regular audits as part of its risk management strategy. So strap in tight and get ready to learn how auditing can help your company thrive in even the most challenging environments!

What is an Audit?

Examining managerial controls and financial statements is done through audit and commercial processes to ensure that they are precise and in line with corporate policies. Audits can help identify potential problems and protect the interests of shareholders.

The Purpose of an Audit

- Audits have the purpose to review past mistakes and make corrections. Audits provide organizations with a goal view of their current condition and the areas in which they need improvement.

- The goal of an audit is not simply to identify problems and offer suggestions for correcting them. But also to create a baseline from which future improvement. By pointing out any alterations or advancements made since the previous audit. Organizations can ensure that their processes continue to meet or exceed industry standards.

- Audits serve several important purposes in an organization. Businesses can ensure their workers are efficient and compliant with laws by performing routine audits. In addition, audits can help train employees to be aware of potential violations and know how to address them before they happen.

Types of Audits

Regular audits are essential to keeping your organization safe and compliant with regulations. They can help you identify problems early, prevent them from becoming more extensive, and save money in the long run. Here are some types of audits:

1. Internal & External Audit:

This is the most common type of audit, usually conducted by the company’s employees. It looks at how the company complies with regulations and other standards. External Audit Services in UAE, which independent auditors conduct.

2. Financial Audit:

This type of audit checks to see if the company is following (GAAP). GAAP is a set of principles that financial professionals use when reporting company data to investors.

3. Compliance Audit:

This type of audit looks for ways the company may violate specific regulations. It can help you avoid fines or other penalties down the road.

4. Operational Audit:

This type of audit checks how well the company is running its operations on a day-to-day basis. It can find problems that could lead to future disasters, such as employee theft or information security breaches.

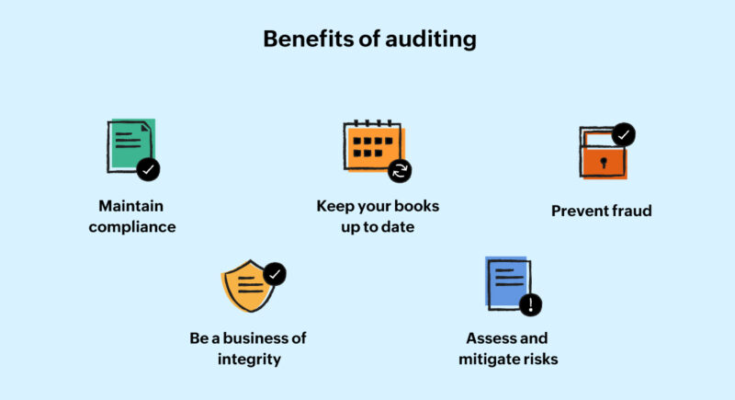

Benefits of Conducting an Audit

Regular audits help organizations identify and correct issues before becoming costly and disruptive. Additionally, they aid in preventing fraud, waste, and abuse. The following are some benefits associated with performing routine audits:

1. Detect Issues Early

A well-run audit is a proactive approach to ensuring organizational health. It can assist you in spotting issues before they cost you money or cause trouble. Long-term, this saves you time, money, and resources.

2. Correct Problems Before They Become Costly or Disruptive

If an issue is detected during an audit, correcting it before it becomes too costly or disruptive to fix is usually possible. This allows you to avoid potential problems, saving your organization a lot of money and hassle.

3. Guard against Fraud, Waste, and Abuse

Conducting regular audits also helps protect your organization from fraud, waste, and abuse. By monitoring your systems for potential issues, you can reduce the chances of fraud and prevent any illegal activities.

Reasons to Conduct Regular Audits

Regular audits are essential to maintaining your organization’s compliance with regulations and best practices. They can help identify issues early, prevent them from becoming more significant problems, and save you time and money in the long run.

Here are four reasons every large organization should conduct regular audits:

1. Compliance with Regulators:

Regular audits can help ensure that your organization complies with all applicable regulations. By identifying potential issues early, you can take appropriate action.

2. Preventing Problems from Becoming Worse:

Regular audits can help identify problems before they become larger issues. This can prevent a crisis from developing and costing more money in the long run.

3. Maintaining Standards of Business Conduct:

Keeping standards high is essential for continued success in today’s marketplace. You may ensure that your company practices meet or surpass industry standards by conducting routine audits.

4. Saving Money and time:

Regular audits might assist you in avoiding future costly errors. Early detection of issues helps you avoid costly future repairs or legal action.